Title: Understanding the Risks of Futures Trading: How to Manage Your Exposures and Minimize Losses

Introduction

Trading in futures markets can be a lucrative way to speculate on price movements in commodities, currencies, or other financial assets. However, it’s essential to understand the risks involved, particularly exchange rate risk. In this article, we’ll delve into the concept of futures premiums and liquidity providers, exploring how they impact your trading strategy and providing valuable insights on how to manage your exposures.

Premium Futures

A futures premium is the difference between the price at which an asset can be bought or sold (the futures contract price) and its current market value. This premium represents the profit made by traders who buy contracts before the market closes, anticipating that prices will rise. Conversely, a spread premium arises when a trader buys a long position in a futures contract while simultaneously selling a short position in the same asset.

For instance, let’s consider an oil trading scenario:

- The current market price of crude oil is $60 per barrel.

- However, the futures contract for this month expires at $65. This means that traders who buy contracts with a premium can expect to earn $5 (65 – 60) per barrel.

- Conversely, traders who sell short positions in the same asset will incur a spread premium of $1 per barrel (e.g., -$10 per barrel).

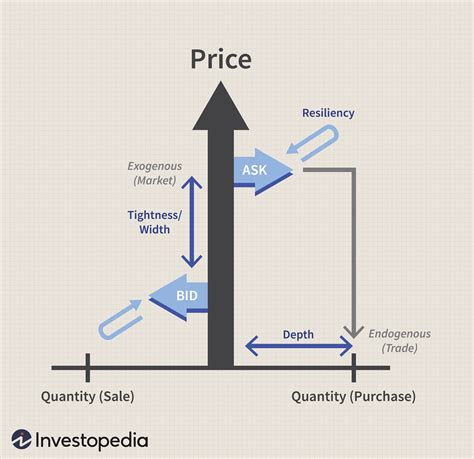

Liquidity Providers

A liquidity provider is an entity that enables trades to occur quickly and efficiently. In the context of futures trading, liquidity providers play a crucial role in providing market access for traders who may not have the necessary capital or time to buy or sell contracts at favorable prices.

There are two main types of liquidity:

- Market maker: A firm that buys and sells contracts on behalf of clients, creating a continuous market when there is no trading activity.

- Brokers’ liquidity: Many brokerages offer their own liquidity providers, which can facilitate trades for clients who do not have direct access to the markets.

Liquidity providers can:

- Facilitate trades between two parties with differing preferences (e.g., buying and selling at different price levels).

- Provides access to a wider range of trading opportunities.

- Offer better execution rates than traditional market makers.

Managing Exposures: Exchange Rate Risk

Exchange rate risk is a significant concern for traders in the futures market, particularly those involved in international transactions. When trading currencies, you are exposed to fluctuations in exchange rates, which can impact your returns and losses. Here are some key points to consider:

- Spot vs. Fancy. Forward Contracts: Trading spot contracts involve the buying or selling of an asset at its current market price (e.g., $60 for oil). In contrast, forward contracts involve agreeing on prices for future deliveries or purchases.

- Forward Rate Agreement (FRA): An FRA is a swap contract that allows traders to lock in exchange rates for a specific period. This provides protection against exchange rate fluctuations, but also exposes you to the risk of interest rate changes and currency market volatility.

- Currency Volatility: Exchange rates can be volatile due to various factors such as economic news, politics, and global events.

- Arbitrage Opportunities: Trading in currencies that are not closely related (e.g., USD/EUR) provides opportunities for profit through arbitrage.

Best Practices for Managing Exposures

To minimize losses and maximize gains:

- Diversify Your Portfolio

: Spread your investments across different asset classes, such as commodities, stocks, and currencies.

- Use Risk Management Techniques: Implement stop-loss orders, position sizing, and other strategies to manage your exposures.

3.

Bir yanıt yazın