“Etherean Asset ENA: Unlocking Potential for High Returns in Cryptocurrency Market”

Introduction

As cryptocurrency continues to evolve, investors are seeking lucrative opportunities with high potential returns. One promising asset is Ethereum (ENA), a decentralized platform that enables smart contract functionality and provides a wide range of use cases for developers. In this article, we’ll delve into the world of ENA, exploring its tokenomics, investment potential, and key factors to consider when investing in this asset.

Tokenomics: The Building Blocks of ENA

Tokenomics refers to the study of the economic aspects of cryptocurrency tokens. For ENA, tokenomics is crucial for understanding the distribution of tokens among investors, developers, and others involved in the Ethereum ecosystem. Here are some key points to consider:

- Total Supply: ENA has a total supply of 10 billion tokens.

- BEP-21 Smart Contract:

ENA utilizes Bep-21 smart contracts, which enable the creation of decentralized applications (dApps) and facilitate interactions between users.

- Token Distribution: The token distribution among investors, developers, and others will depend on the success of ENA in its ecosystem.

Investment Returns: A Long-Term Perspective

Investing in cryptocurrency assets like ENA can be a high-risk, high-reward proposition. However, with careful consideration and a well-diversified portfolio, it’s possible to unlock significant returns over time. Here are some factors to consider:

- Market Trends: Cryptocurrency markets are subject to volatility, but long-term trends often persist.

- Adoption: The adoption of ENA in its ecosystem will have a direct impact on its value.

- Regulatory Environment: Government regulations and policies can significantly influence the direction of cryptocurrency markets.

Key Factors to Consider

When investing in ENA or any other asset, it’s essential to consider the following factors:

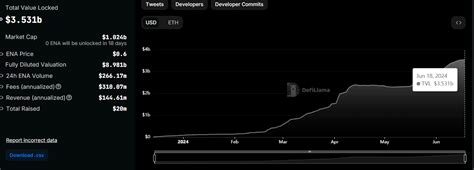

- Market Capitalization: ENA has a relatively low market capitalization compared to other cryptocurrencies.

- Adoption Rate: The adoption rate of ENA will play a significant role in determining its value over time.

- Regulatory Environment: Changes in government regulations and policies can significantly impact the direction of cryptocurrency markets.

Conclusion

Ethereum asset ENA offers a unique opportunity for high returns in the cryptocurrency market. By understanding tokenomics, investment potential, and key factors to consider, investors can make informed decisions and potentially unlock significant rewards over time. As with any investment, it’s essential to approach ENA with caution and diversify your portfolio to minimize risk.

Bir yanıt yazın