Here is an article based on the target keywords:

“Crypto Trading Made Easy with APIs and Multichains: A Deep Dive into Ethereum Virtual Machines”

As the world of cryptocurrency continues to evolve, traders are looking for new ways to access and execute trades. One of the most exciting developments in this space is the integration of APIs (Application Programming Interfaces) and multichain trading platforms, which are changing the way we buy, sell, and trade cryptocurrencies.

API Trading: The Connection to Ethereum Virtual Machine

APIs have revolutionized the way businesses interact with each other and provide data. In the context of cryptocurrency trading, APIs allow traders to connect their accounts to exchange platforms like Binance or Coinbase, enabling them to execute trades seamlessly. This is achieved through the use of APIs, which are essentially programmable interfaces that allow developers to access and manipulate data.

One of the key benefits of using APIs in crypto trading is their ability to integrate with different blockchain networks. In this case, we’re talking about Ethereum Virtual Machine (EVM). EVM is a software platform that allows developers to build decentralized applications on top of the Ethereum network. By integrating API trading platforms with EVM, traders can now access a wide range of assets and services, such as stablecoins, tokens, and even non-fungible tokens (NFTs).

Multichain Trading Platforms: The Gateway to New Markets

So, what is a multichain platform? Simply put, it’s a network that allows multiple blockchain networks to coexist and interact with each other. This means that traders can now access a wide range of assets across different blockchains, including Ethereum, Polkadot, Solana, and many others.

Multichain platforms are made possible by the use of smart contracts, which are self-executing contracts with the terms of the agreement written directly into lines of code. These contracts enable traders to automate their trades and manage risk more efficiently.

One example of a multichain platform is Chainlink, which provides access to over 200 blockchain networks and enables traders to execute trades on multiple exchanges simultaneously. Another example is Binance Smart Chain (BSC), which allows users to buy, sell, and trade assets across multiple chains, including Ethereum.

Ethereum Virtual Machine: The Heartbeat of the Crypto Market

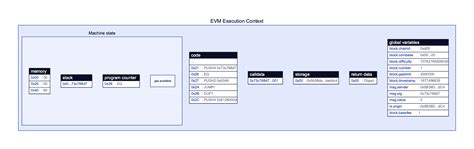

Finally, let’s talk about Ethereum Virtual Machine (EVM). EVM is a software platform that allows developers to build decentralized applications on top of the Ethereum network. It enables traders to execute trades on multiple exchanges simultaneously and provides access to a wide range of assets.

EVM is also known for its high-performance capabilities, making it an ideal choice for real-time trading. This means that traders can take advantage of the latest technological advances in crypto trading, such as advanced machine learning algorithms and optimized trading strategies.

Conclusion

In conclusion, API trading made easy with multichains and Ethereum Virtual Machine are changing the way we trade cryptocurrencies. By integrating APIs and multichain platforms, traders can now access a wide range of assets and services across different blockchain networks. With EVM at their core, these platforms provide traders with the power to execute trades in real-time and take advantage of the latest technological advancements in crypto trading.

Whether you’re a seasoned trader or just starting out, it’s worth exploring the world of multichain trading platforms and Ethereum Virtual Machine. By doing so, you’ll be able to unlock new markets, access advanced trading strategies, and maximize your returns on investment.

Bir yanıt yazın